China PVD Coating Equipment Industry Panorama 2020 (with Industrial Policy, Market Scale, Competitive Landscape, etc.)

PVD (Physical Vapor Deposition) technology that is, under vacuum conditions, the use of physical methods, the material source - solid or liquid surface gasification into gaseous atoms, molecules, or part of the ionization into ions, and through the process of low-pressure gases (or plasma), in the surface of the substrate deposition of thin films with a particular function of the technology. Its early in the early 20th century has been some applications, but 30 years of rapid development, become a very broad application prospects of the new technology, currently its main application in the semiconductor manufacturing process, in the injection mold, hardware molds and mechanical and chemical fields have applications.

The PVD equipment is the carrier of the PVD technology, which mainly consists of pumps, sputtering devices, vacuum measurement and leak detection systems.

Figure 1: Schematic diagram of PVD equipment industry chain

Figure 2: PVD (Physical Vapor Deposition) links in the semiconductor industry chain

Industrial policy - for PVD equipment is more important

From the policy environment, China's PVD equipment is more important, which is mainly reflected in the relevant policies for the development of semiconductor equipment support. Such as the "13th Five-Year Plan" of the National Science and Technology Innovation Plan, thin film equipment (PVD equipment, CVD equipment, etc.) is listed as the country needs to overcome the high-end manufacturing equipment; "National High-tech Industrial Development Zone," "Thirteenth Five-Year Plan," also mentioned, to promote the IC key equipment key core technology breakthroughs and applications.

Figure 3: Interpretation of China's PVD industry policy planning

Technical process - expanding range of applications

PVD was initially developed mainly for the manufacture of artificial satellites that require wear-resistant parts, and with the continuous development of its processing technology, the scope of application of PVD technology has begun to expand.

Currently, PVD has evolved a more fixed process of gasification, migration and deposition, and different PVD technologies have evolved according to different materials and downstream applications.

Figure 4: PVD Development History

Figure 5: Brief analysis of PVD process

Figure 6: Comparison of PVD Technologies

Competitive Landscape - Applied Materials Take the Lead

The global PVD equipment market, Applied Materials (AMAT) basically realized the monopoly. SEMI data show that AMAT accounted for the global PVD market share of about 85%, followed by Evatec and Ulvac, accounting for 6% and 5% respectively.

Figure 7: Competitive Landscape of Global PVD Equipment Market (Unit: %)

Market Size - Stable growth in market size

In recent years, the global PVD equipment market has been growing steadily, and in 2019, the global PVD equipment market size has exceeded $2.5 billion. Although in 2020, the global economy was hit by the new crown epidemic, showing a clear downward trend, but the growth of the downstream field of PVD equipment is very strong, and it is expected that since 2021, the consumption of global PVD coating machine will further show an upward trend, and the market size will reach about 3.251 billion U.S. dollars in 2025.

Figure 8: Change in Global PVD Equipment Market Size, 2014-2025 (in USD Billion)

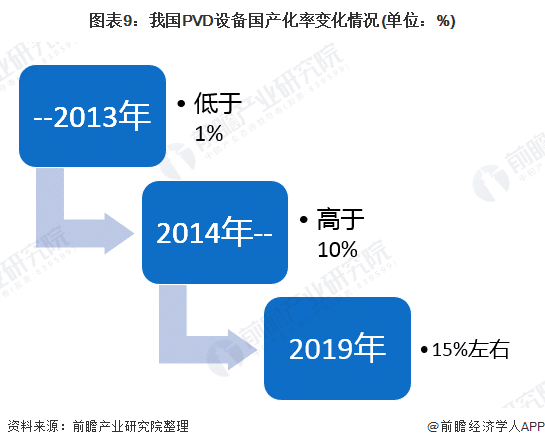

Localization analysis - increasing localization rate

In recent years, China's PVD equipment manufacturing process continues to progress, the localization rate of PVD equipment continues to rise, as of 2019, the localization rate of China's PVD equipment has reached about 15%. However, from the point of view of the progress of China's PVD equipment manufacturing technology, some types of products China still has no production capacity for the time being, and there is still a certain gap with overseas leading enterprises.

Figure 9: Changes in the localization rate of China's PVD equipment (unit: %)

Figure 10: Progress of related technologies in China (unit: nm)

The above data comes from China Semiconductor Industry Strategic Planning and Corporate Strategy Consulting Report by Prospect Industry Research Institute, while Prospect Industry Research Institute provides solutions for industrial big data, industrial planning, industrial declaration, industrial park planning, and industrial investment attraction.

Naxau Vacuum Coating Processing - Naxau AM

Naxau Vacuum Coating Processing - Naxau AM